Industry-Leading Cash Flow Engine, Analytics and Data Management for MSRs

An all-inclusive MSR valuation, risk modeling and data management solution enabling investors, originators and servicers to more effectively manage their mortgage data and portfolios.

MSR Bid Analysis – Fast Tape Cracking for Loan-Level Forecasting

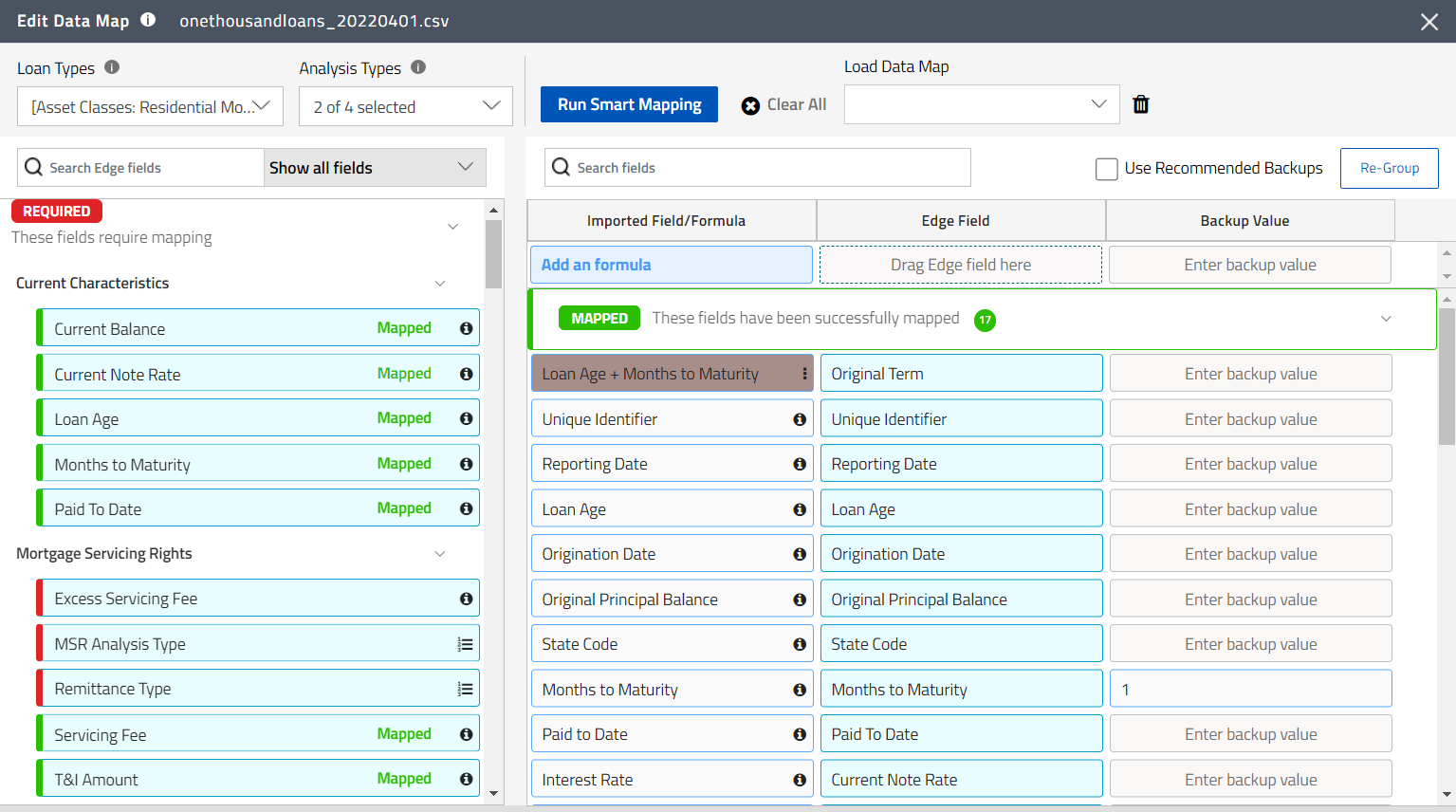

Powered by Smart Mapping tools and Configurable QC, RiskSpan streamlines and automates MSR data ingestion across multiple servicers and data sources:

Quickly load and map portfolios from different counterparties

Apply machine learning model that accounts for past experience

Leverage RiskSpan’s recommended QC rules and backup values

Access QC audit reports showing mapping choices and exceptions

View MOM data QC visualization reports

Interactively Query/Filter Loan Data and Historical Performance Metrics

(Direct Data Access via Snowflake Also Available)

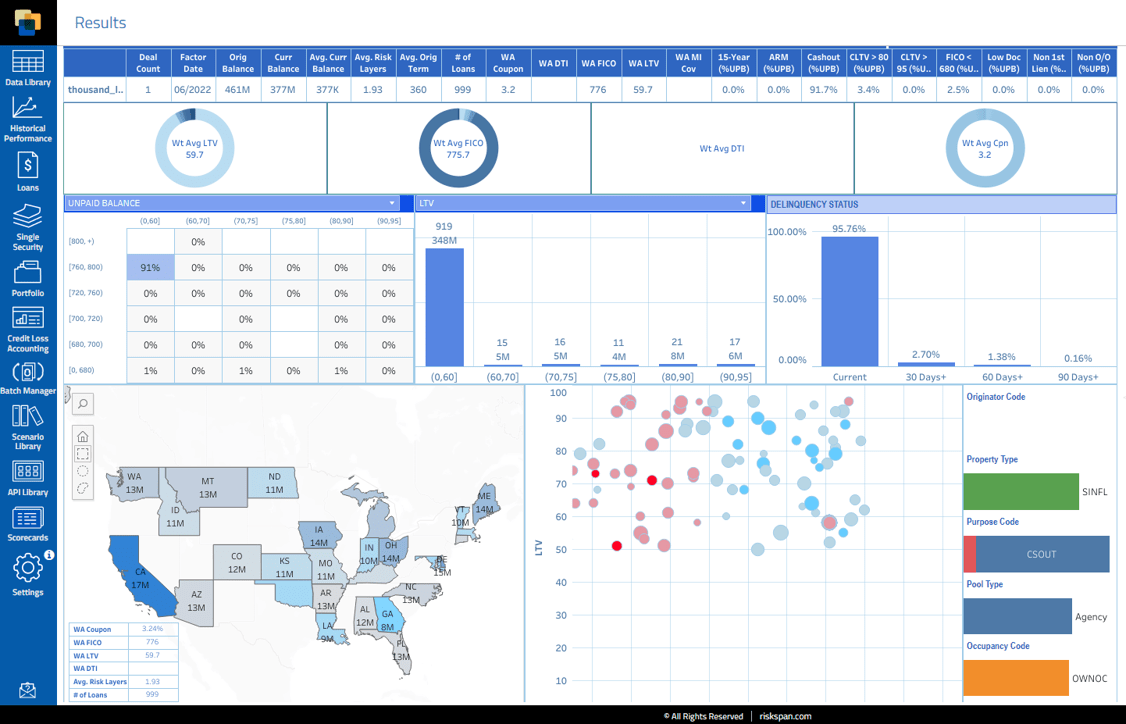

Access interactive Edge Loans module:

- Create Composition reports

- Query/filter loan data

- Extract loan data for external constituents

Report on historical performance and filter performance metrics across dimensions:

- Prepayment

- Default

- Recapture rates

Leverage suite of customized data visualization reports (via Tableau)

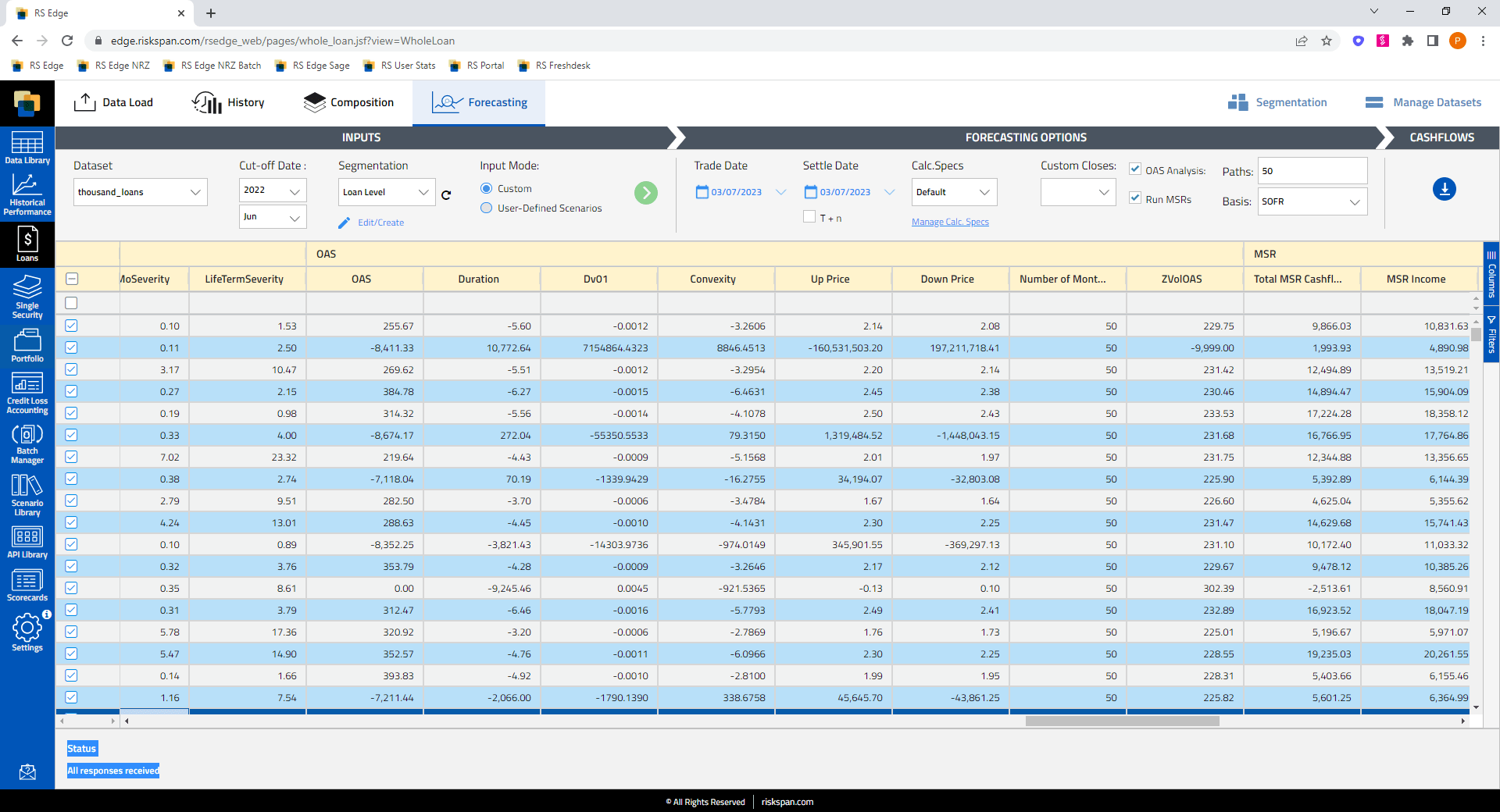

Advanced Loan-Level MSR Cash Flow Engine and Analytics

Industry-leading cash flow engine allows for full transparency and control of income and expense assumptions at a granular level including recapture rates

Full/excess MSR cash flow engines and prepay/credit models run at loan level across Conventional/Ginnie/Private-label MSRs

Forecasts include detailed MSR component cash flows, option-adjusted valuations, and risk/scenario metrics

Results can be viewed across various pre-canned or custom segmentations

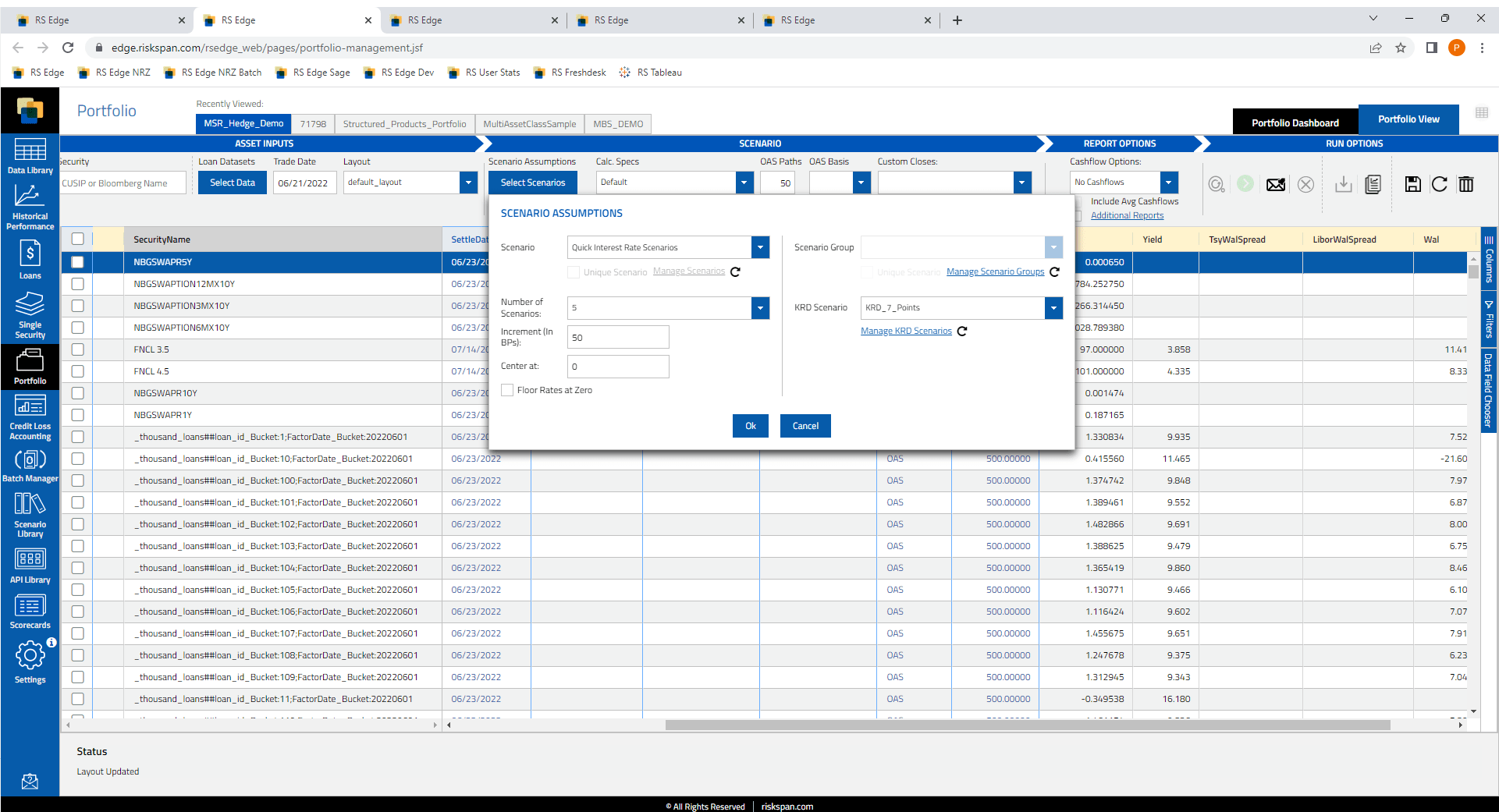

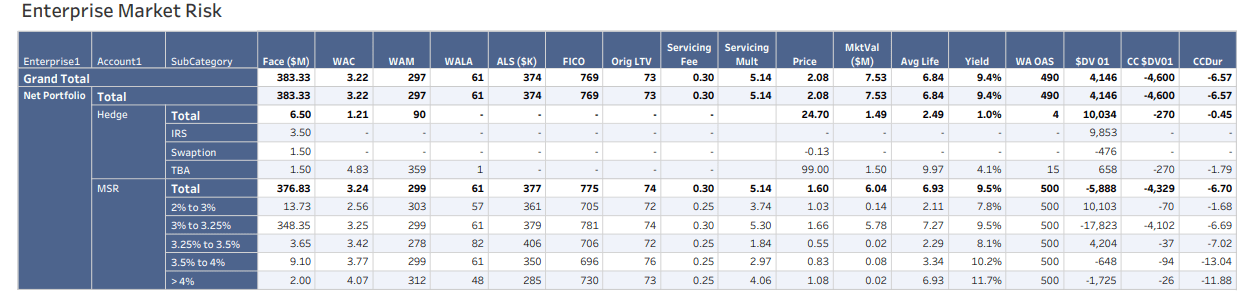

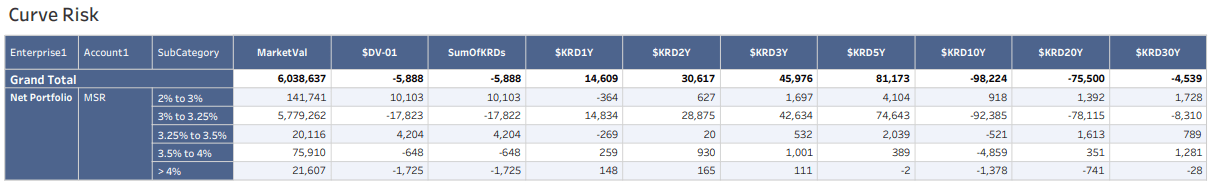

MSR Portfolio Risk Managment (Risk as a Service)

Comprehensive Solution for Daily MSR and Hedge Valuation/Analytics

Leverage modern technology and a managed service approach for reliable and timely daily MSR valuation and risk analytics

Automated, overnight run process allows for on-time delivery of daily analytics run at the loan-level

Incorporates QC checks to ensure high quality of results/reports

Flexible approach to incorporating custom model dials and MSR assumptions

Options available to run at a repline-level to facilitate extensive scenario analyses in fastest time possible

Leverage modern technology and a managed service approach for reliable and timely daily MSR valuation and risk analytics

Contact us to learn more, get a free demo, or request a free trial

Resources

Article

Loans & MSRs: Managing model assumptions and tuners the easy way

How an MSR Analytical Solution Can Boost Your Mortgage Banking Business

What Do 2024 Origination Trends Mean for MSRs?

GenAI Applications for Loans and Mapping Data

Celebrating Women’s Contributions by the Numbers

![Enriching Pre-Issue Intex CDI Files with [Actual, Good] Loan-Level Data](https://riskspan.com/wp-content/uploads/2024/03/Picture1-1024x576.png)

Enriching Pre-Issue Intex CDI Files with [Actual, Good] Loan-Level Data

RiskSpan to Launch Usage-based Pricing for its Edge Platform at SFVegas 202...

What is the Draw of Whole Loan Investing?

RiskSpan, Dominium Advisors Announce Market Color Dashboard for Mortgage Lo...

The future of analytics pricing is RiskSpan’s Usage-based delivery model

RiskSpan’s Top 3 GenAI Applications for 2024

Connect with us at SFVegas 2024

How reliable is your data?

Our team of quants and data

scientists is available on demand

to provide custom support.