Unlock Loan and MSR Value

Easy loan-level analysis for better identification of retention opportunities and smarter portfolio management

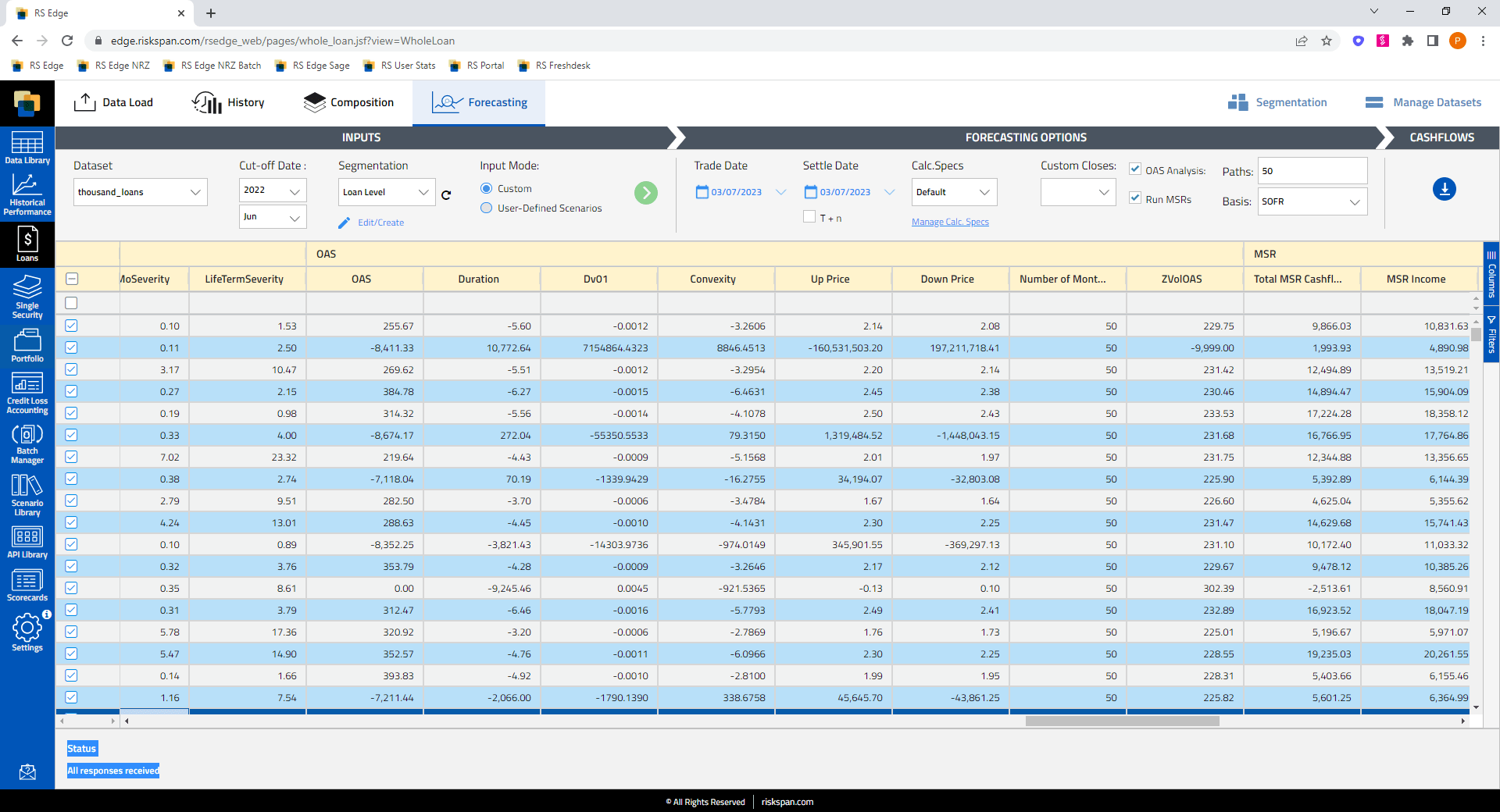

Advanced Loan-Level MSR Cash Flow Engine and Analytics

Industry-leading cash flow engine allows for full transparency and control of income and expense assumptions at a granular level including recapture rates

Full/excess MSR cash flow engines and prepay/credit models run at loan level across Conventional/Ginnie/Private-label MSRs

Forecasts include detailed MSR component cash flows, option-adjusted valuations, and risk/scenario metrics

Results can be viewed across various pre-canned or custom segmentations

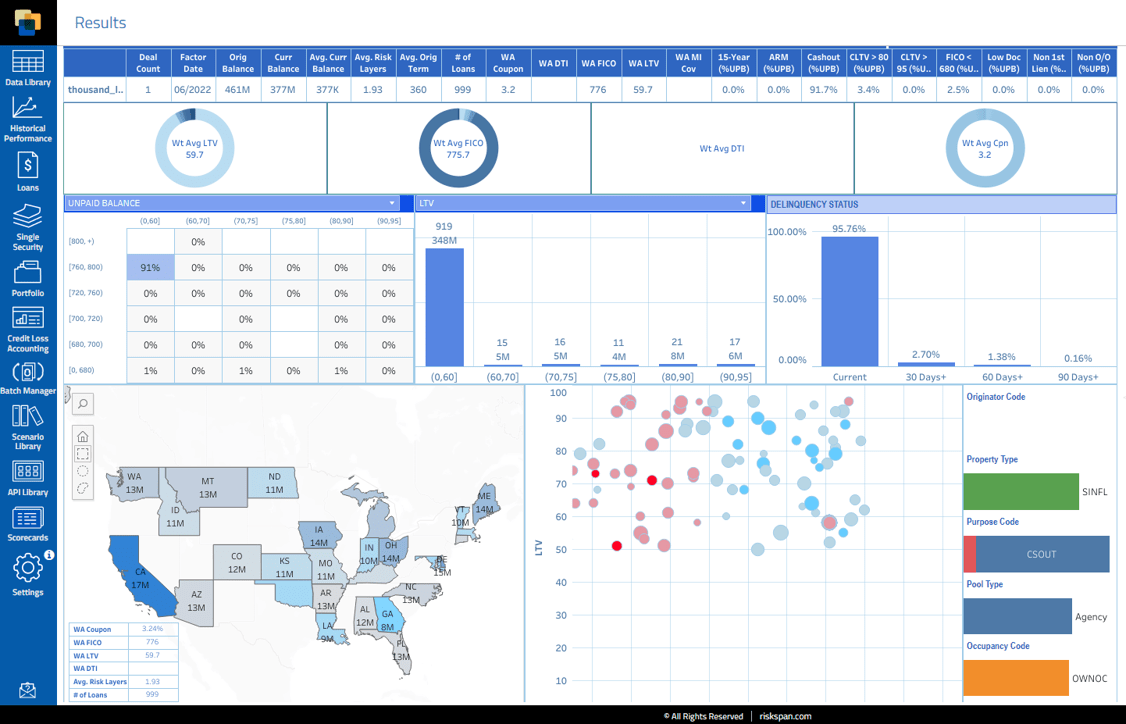

Interactively Query/Filter Loan Data and Historical Performance Metrics

(Direct Data Access via Snowflake Also Available)

Access interactive Edge Loans module:

- Create Composition reports

- Query/filter loan data

- Extract loan data for external constituents

Report on historical performance and filter performance metrics across dimensions:

- Prepayment

- Default

- Recapture rates

Leverage suite of customized data visualization reports (via Tableau)

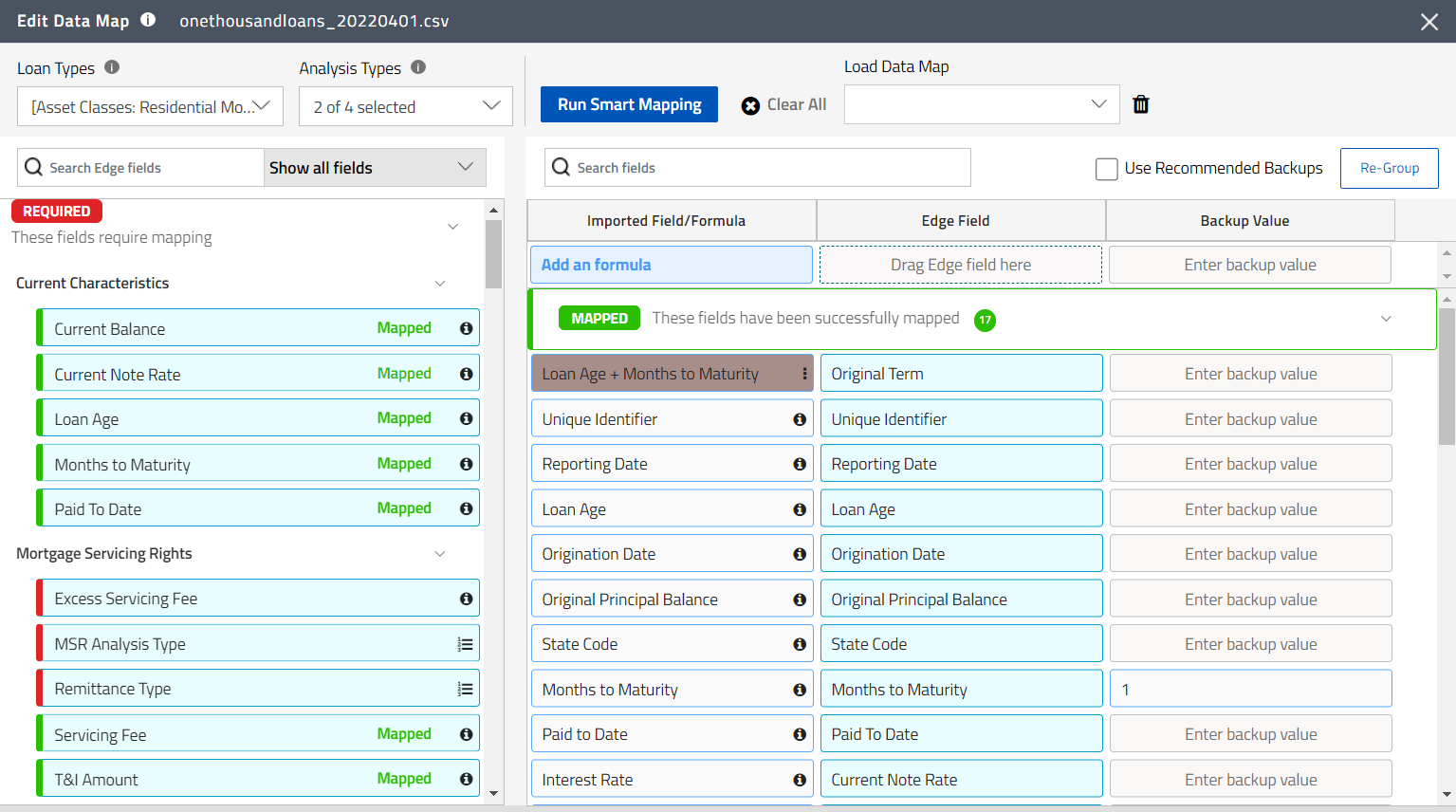

MSR Bid Analysis – Fast Tape Cracking for Loan-Level Forecasting

Powered by Smart Mapping tools and Configurable QC, RiskSpan streamlines and automates MSR data ingestion across multiple servicers and data sources:

Quickly load and map portfolios from different counterparties

Apply machine learning model that accounts for past experience

Leverage RiskSpan’s recommended QC rules and backup values

Access QC audit reports showing mapping choices and exceptions

View MOM data QC visualization reports

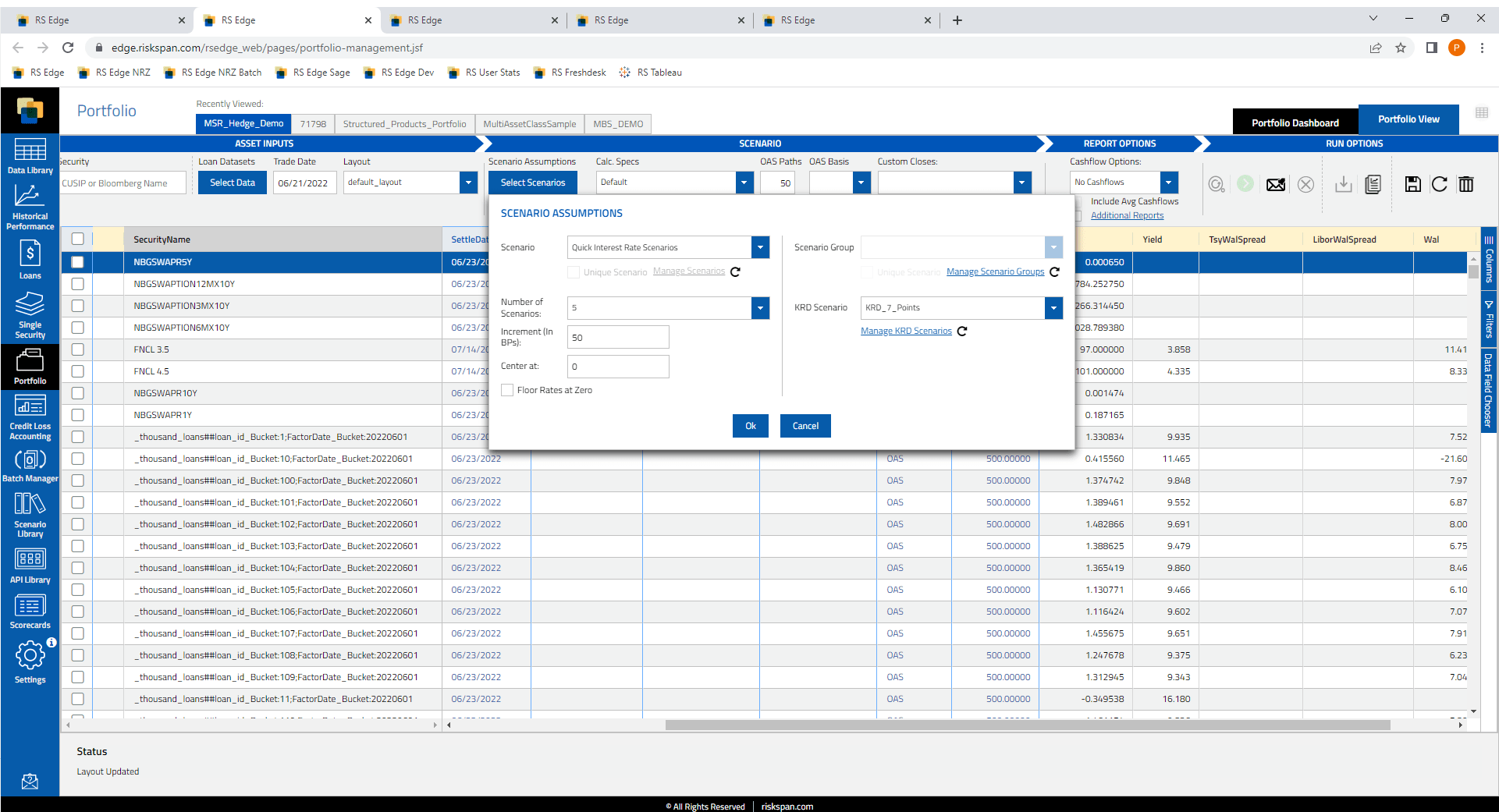

MSR Portfolio Risk Managment (Risk as a Service)

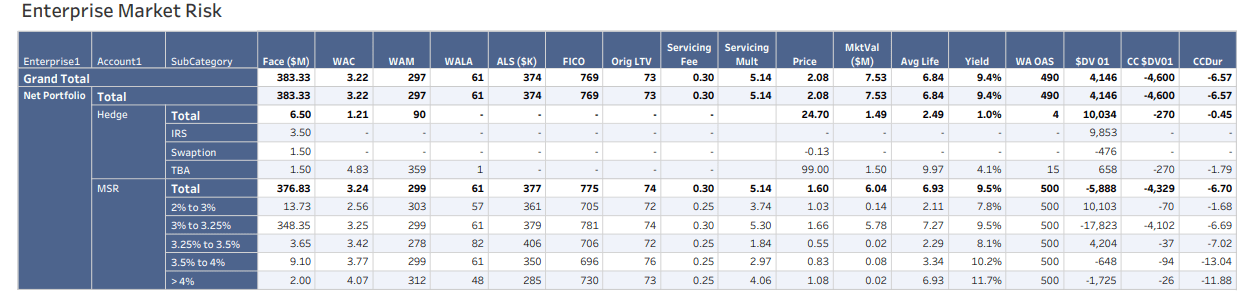

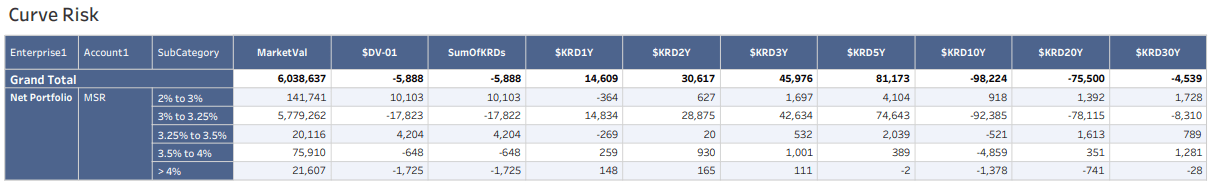

Comprehensive Solution for Daily MSR and Hedge Valuation/Analytics

Leverage modern technology and a managed service approach for reliable and timely daily MSR valuation and risk analytics

Automated, overnight run process allows for on-time delivery of daily analytics run at the loan-level

Incorporates QC checks to ensure high quality of results/reports

Flexible approach to incorporating custom model dials and MSR assumptions

Options available to run at a repline-level to facilitate extensive scenario analyses in fastest time possible

Leverage modern technology and a managed service approach for reliable and timely daily MSR valuation and risk analytics

Contact us to learn more, get a free demo, or request a free trial

Resources

Article

Navigating Headwinds with Data and AI: July Models & Markets Recap

Humans in the Loop: Ensuring Trustworthy AI in Private ABF Deal Modeling

June 2025 Models & Markets Update – Predictive Power Amid Economic Uncertai...

Private Credit Market Pulse: What LPs Want from Their Data and How to Deliv...

RiskSpan’s August 2025 Models & Markets Call

Design Smarter — How AI is Changing UX from Idea to Execution

Models & Markets Update – May 2025

Using LLMs as judges for validating deal cash flow models: A new frontier i...

Mounting Pressure in Non-QM Credit: What March 2025 Data Signals for Risk M...

RiskSpan’s April 2025 Models & Market Call: Credit Model v7, Prepay Volatil...

RiskSpan Announces the Appointment of Howard Kaplan and Susan Mills to Advi...

From AI Hype to Helpful Assistant: AI Agents are coming soon to the RiskSpa...

How reliable is your data?

Our team of quants and data

scientists is available on demand

to provide custom support.