ABA Landing Page — Private Credit: Asset-Backed Finance Analytics

Private Credit:

Asset-Backed Finance Analytics

AI-Powered Surveillance, Data Collection & Cashflow Modeling for Scalable Portfolio Management

Get a free trial or demo

THE PROBLEM: Private credit ABF portfolios are diverse and complex, encompassing various collateral types, structural features, and data formats. Traditional portfolio and risk management workflows remain fragmented and manual, creating inefficiencies that constrain growth.

Introducing the only end-to-end solution for private credit deal modeling, portfolio surveillance, and risk management, enabling investors to optimize decision-making and scalability.

AI-Driven Data Extraction & Structuring

Turn Unstructured Deal Data into Actionable Intelligence

- Automated document processing extracts key terms, conditions, and structural details from loan and deal documents.

- AI-powered data validation minimizes human error and ensures accuracy in portfolio analytics.

- Standardized data models integrate with Snowflake for seamless analysis.

- Extracted deal structures, waterfalls, triggers, and covenants drive accurate cashflow modeling, portfolio surveillance, and reporting.

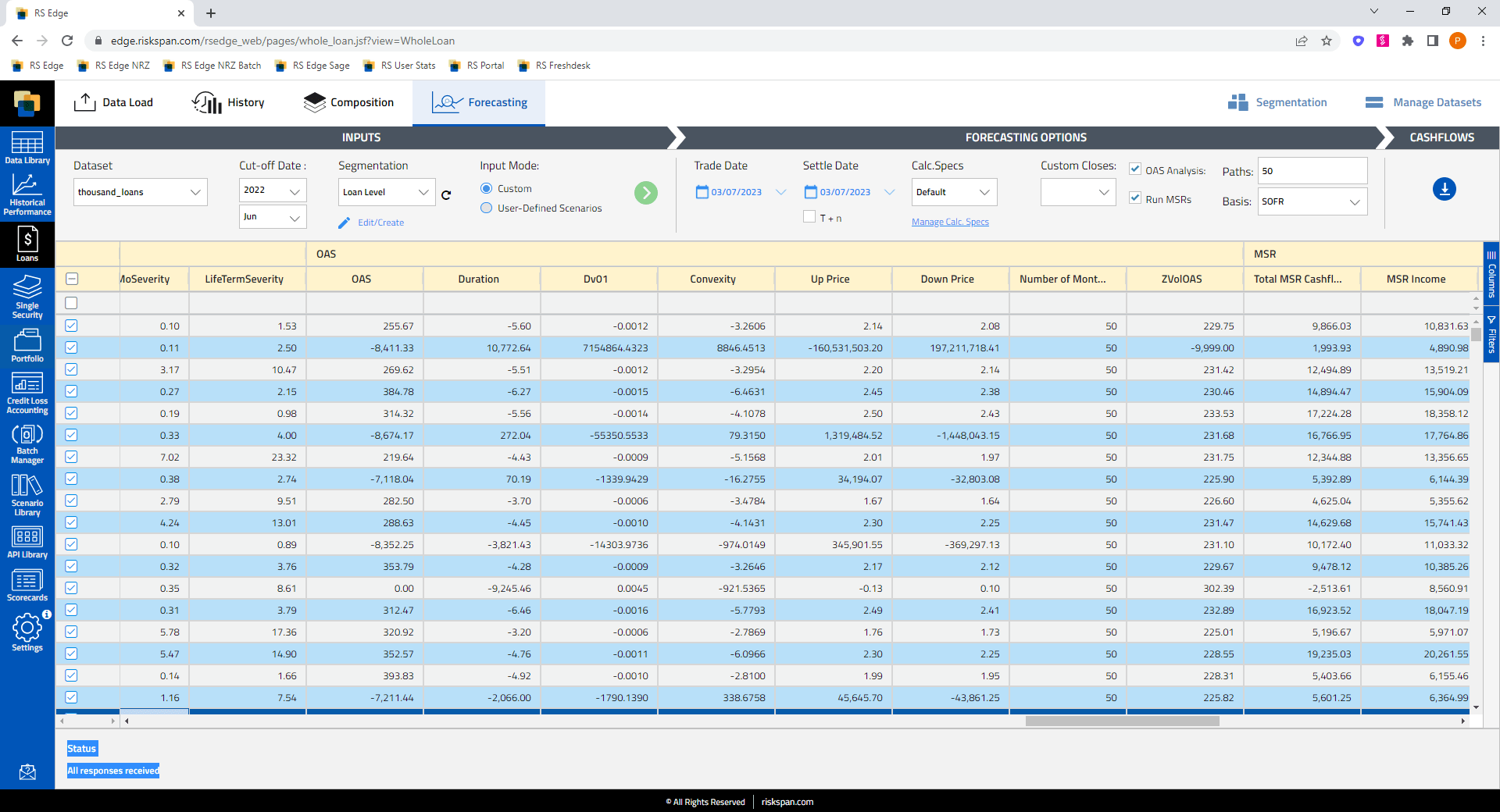

Advanced Cash Flow Modeling for Private Credit Portfolios

Scalable, Customizable AI-Powered Cash Flow Analytics

- AI-generated open-source cash flow modeling provides a customizable starting point for deal structuring.

- Custom security ID integration ensures seamless tracking in RiskSpan’s Edge Platform.

- Scenario-based forecasting & pricing analytics deliver insights tailored to private credit portfolios.

- Automated API access streamlines portfolio monitoring and cashflow analysis.

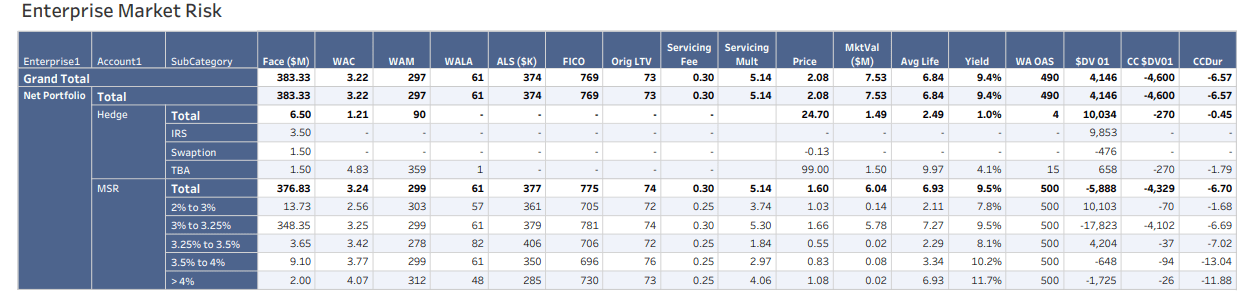

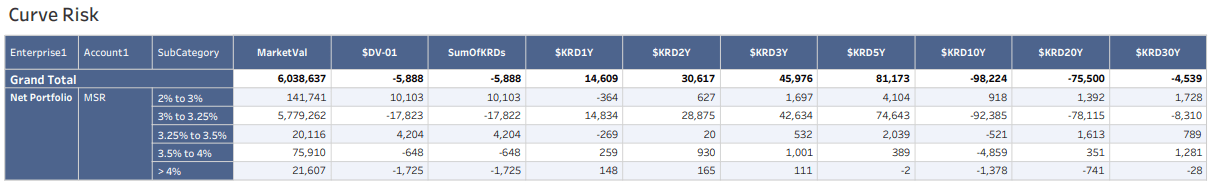

Private Credit Portfolio Risk & Surveillance

Comprehensive Risk Management & Real-Time Monitoring

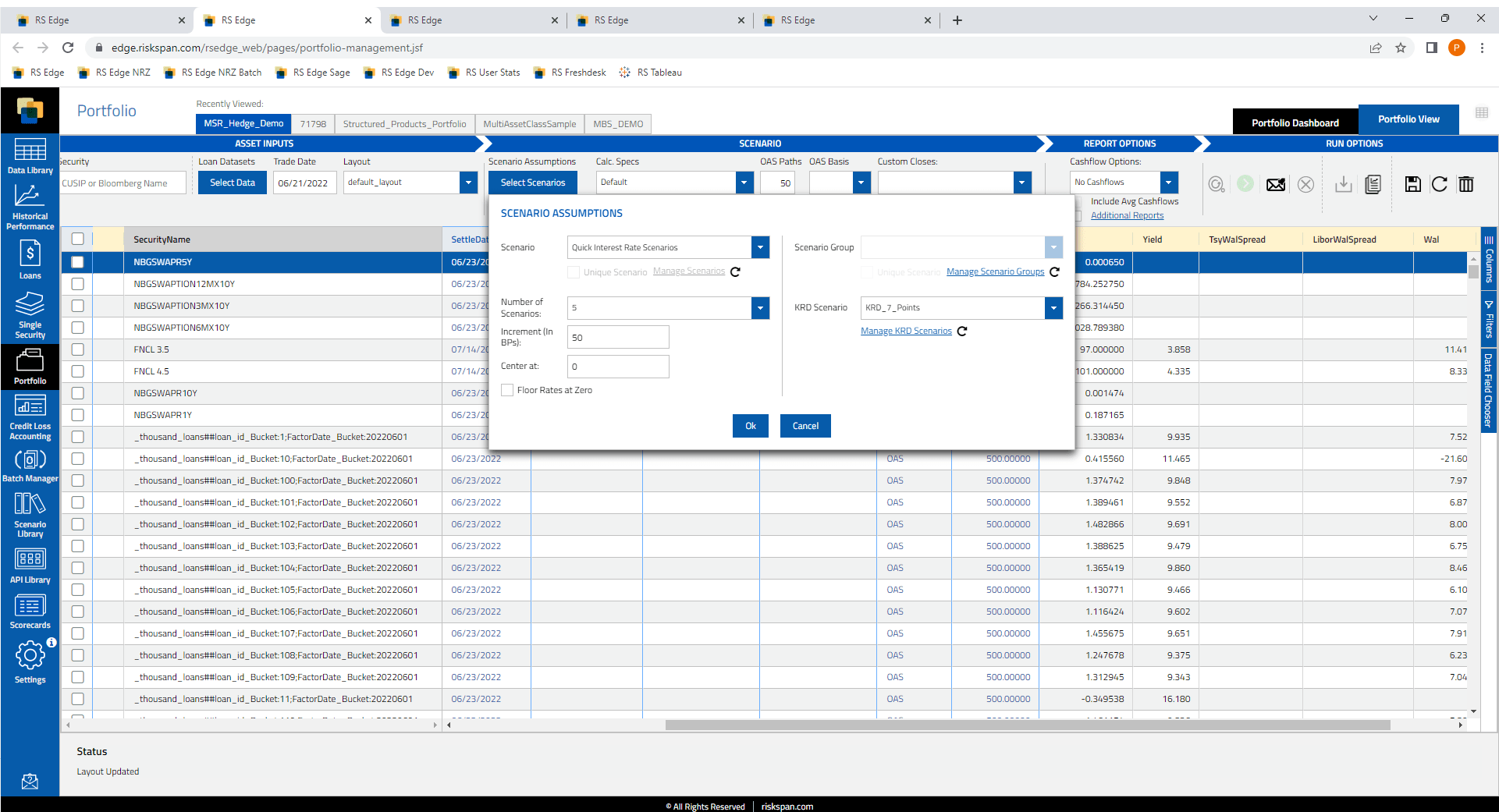

- Run daily pricing & risk analytics across public and private assets in a single framework.

- Loan-level risk assessments enhance portfolio granularity and accuracy.

- Automate covenant tracking & remittance report ingestion to monitor deal performance and triggers in real-time.

- Custom stress testing & scenario analysis tailored to private credit portfolios.

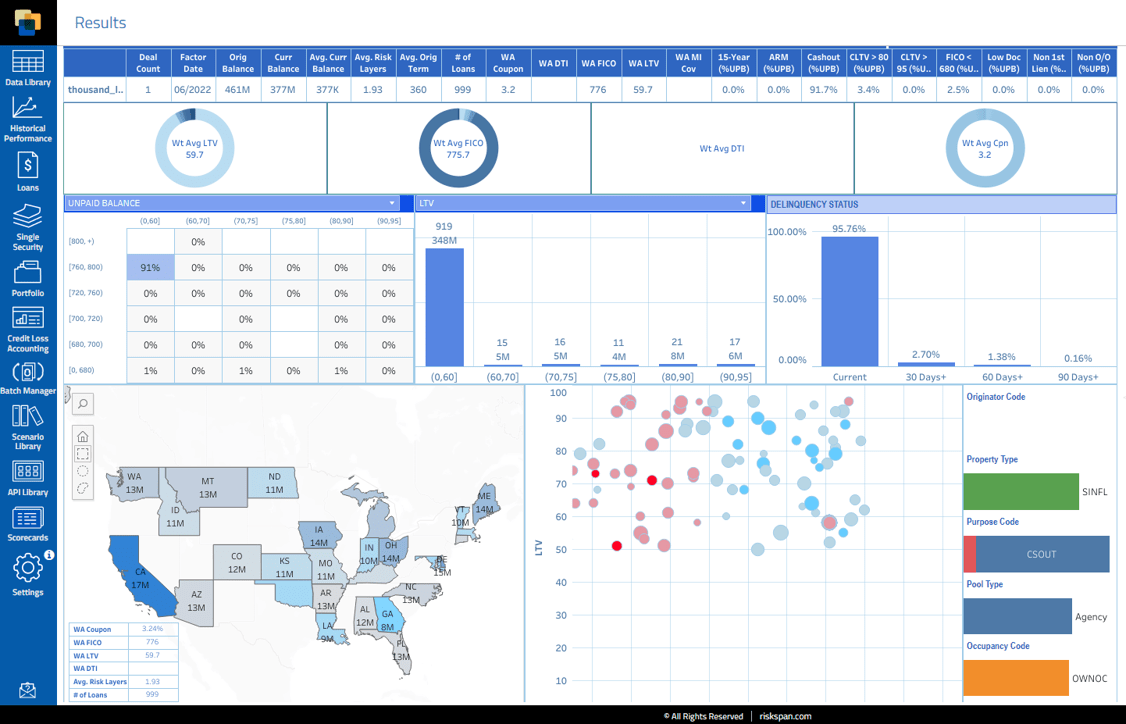

Resi Loan Investor? We Have You Covered There, Too!

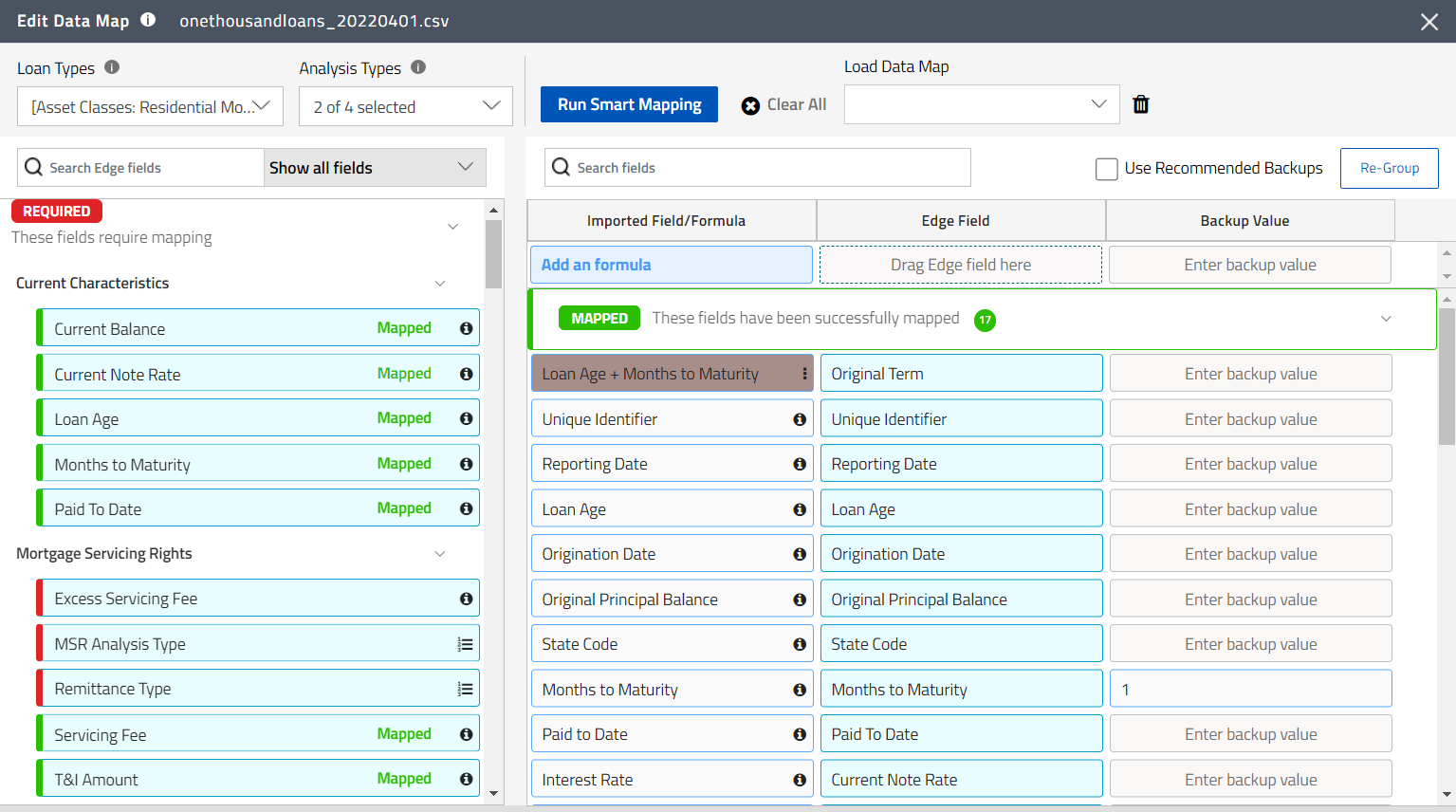

- Outsource the Heavy Lifting of Consolidating and Mapping Servicer Data: Powered by Smart Mapping and Optimized QC rules, RiskSpan automates data ingestion across multiple servicers and data sources:

- Dynamic Query/Filter Loan Data and Historical Performance Metrics: Analyze loan data using query/filter and custom composition reports; Generate customized data visualization reports

- Loan Bid Analysis Trading Quality Risk Models, Loan-Level Valuations: RiskSpan has purpose-built tools and models to support active buyers/sellers of whole loans

- Portfolio Risk Management Powerful Scalability for Daily Analytics.

Why Private Credit Investors Choose RiskSpan

-

Eliminate manual surveillance bottlenecks that delay critical performance insights.

-

Improve loan acquisition & investor reporting workflows with AI-powered automation.

-

Proven success supporting asset managers, insurance firms, and private credit funds.

-

Seamless integration with existing risk management and portfolio reporting frameworks.

Unlock the Power of AI for Private Credit Investing

📩 Contact us today to schedule a demo and streamline your private credit analytics.

🔗 Request a Demo

Built for Speed, Scale and Affordability

Cloud-Native for 15 Years

Resources

Private Credit Investors

Humans in the Loop: Ensuring Trustworthy AI in Private ABF ...

Private Credit Market Pulse: What LPs Want from Their Data ...

Models & Markets Update – May 2025

Using LLMs as judges for validating deal cash flow models: ...

RiskSpan’s April 2025 Models & Market Call: Credit Model v7...

RiskSpan Announces the Appointment of Howard Kaplan and Sus...

Mortgage Prepayment and Credit Trends to Watch

The Future of Private Credit: Growth Challenges, and How Ri...

February 2025 Model Update: Mortgage Prepayment and Credit ...

Non-QM Delinquencies Are Rising—And Home Prices Aren’t Help...

Case Study: How a leading loan and MSR investor reduced cos...